REBALANCING UPDATE AND MARKET COMMENTS: October 2020

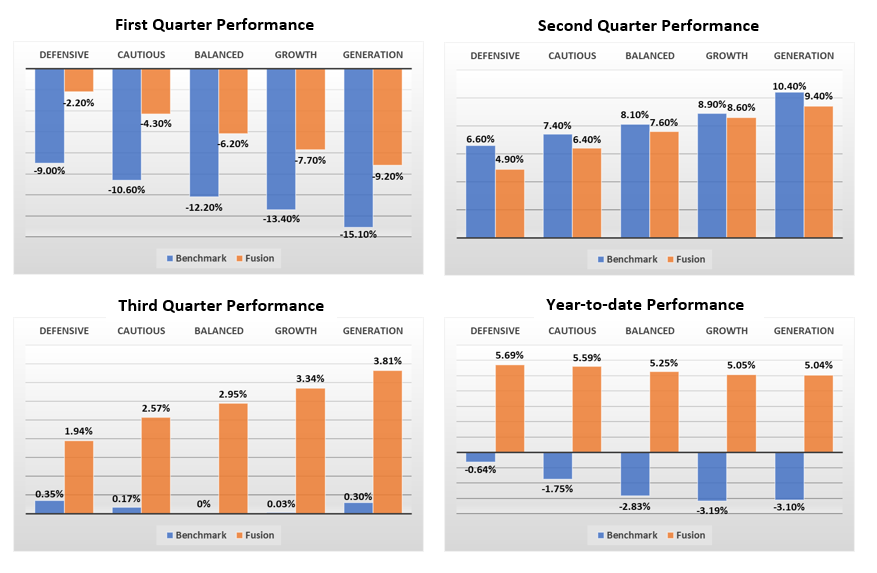

Since the previous rebalance in July, all Fusion portfolios have delivered steady positive returns, varying between +1% for low risk portfolios to +2.6% for the risky ones despite close to zero returns of the corresponding benchmarks as the markets were mostly moving sideways. This resulted in the outperformance of Fusion portfolios over their corresponding benchmarks across all risk categories of between 1% and 2%.

Most of the outperformance came from Fusion’s fund selection, with a number of funds within the portfolios performing significantly better than the industry average for the period. The rest of the outperformance is mainly explained by the tactical tilts within the regional allocations.

Active Range – Perfomance in Charts

Optima Range – Perfomance in Charts

Market Commentary

If we need to sum up the last quarter in two words, they would be “Nothing happened”. The same factors which have been in play since the start of COVID-19 are still with us. They are – the government financial stimuli, the rate of infection, the speed of recovery of GDP, the upcoming US president election, Brexit and the trade wars. These factors move up and down in relative importance and media prominence. They ignite political debates. However, in the absence of a clear winner, they ultimately led this quarter to a relatively flat market.

The “second wave” of COVID-19 infections, which we wrote about last time, indeed has materialised. However, the economic (and human) impact of this is incomparable to the impact of the “first wave” – people changed their habits, learned to live and, what is more important for markets, they learned to shop in the new reality. Although the speed of recovery was somewhat muted in the last quarter, this reflects, we think, the speed of the initial recovery and our changed preferences rather than the long-lasting damage of the pandemic.

The economic stimuli that we spoke about last time have not been as speedy as one might have hoped. Political uncertainty, which is typical for a pre-election quarter, did not allow a $2.2 Trillion package which US Democrats were aiming to be agreed. Overall, the US elections are, in the short term, the most talked about factor for the markets. If Biden wins, analysts expect government support to the economy but, at the same time, close attention to tech giants and an increase in taxes which, in turn, immediately affects dividends and, as a result, equity valuation. If Trump wins, then the support headline number, probably, will be lower but, at the same time Trump can double down on taxes and initiate a program of direct support of equities, similar to what Japan did. This shows that a bet on the US election is not necessarily a bet on the equity markets and one should not attach directional significance to the immediate presidential result.

The so-much-talked-about unprecedented government support which engineered a quick initial bounce-back for the economy is not without its costs. An example would be the actions of the European Central Bank – its stimulus offensive against the pandemic is distorting the debt market as far as 30 years into the future. The decrease in euro funding costs amid record excess liquidity has triggered two things — a wave of buying long-term protection against the risk of higher rates, and a re-assessment of existing liabilities in line with the market prices. These sorts of technical effects can have a huge impact on how firms conduct their business and how financial institutions, insurance companies and pension funds manage their risks which, in their own term, can further distort the markets. In short, there is a cost to just printing money, a cost which we have not quite comprehended yet.

In the short run, however, printing money is helping financial markets. Bloomberg’s Global Money Supply is currently standing at nearly $92 Trillion compared with $76 Trillion back in March and the free cash is pushing financial markets up. Amid the short-term uncertainty, we maintain a pro-risk stance from the last quarter rebalancing, adding slightly to risky assets at the expense of exposure to government bonds.

The long-term government bonds look much less attractive in the current markets. We expect low yield, increased risk from the rising inflationary pressures and diminishing protection quality from this asset class to the portfolios. At zero yield and low likelihood of negative rates (nearly half of responders to CitiFX survey think that Bank of England will never implement negative rates), the upside for the government bonds is now limited even in the case of severe market stress. Fusion portfolios continue to see a decrease in long-term government bond holdings.

The “wave of money” will lift (nearly) every ship, but some ships will be lifted higher. Japan, among developed world countries, is one of the most attractive in our view. Bank of Japan is re-iterating forthcoming policy actions to take “swift and appropriate action as needed if the economic recovery is delayed”. At the same time, analysts are raising economic estimates for Japanese companies at the fastest pace in over two years.

North Asia has generally remained resilient through the crisis due to the less cyclical economic structure and higher share of technology sectors. China, the main player there, had the deepest yet shortest recession. Yet, by the second quarter the country has recovered 80% of its pre-crisis level. This re-balance sees an increase in exposure to North Asia.

The last factor we want to touch upon is Brexit. It seems that this 4 year-long story is finally coming to the end. It is likely that by the end of this year, Britain will be out. Most likely with some sort of trade agreement. We expect it to be positive for the UK markets and positive for the pound. However, as always, the risk of sudden disruption remains and we have not yet adjusted our currency hedging for the portfolios which continue to reflect a cautious stance on the currency. This might result in some underperformance due to the pound’s strength but we are prepared to accept this to maintain its risk-protection features.

Re-Balancing Portfolios

Looking forward, we continue to combine strategic allocations through models with tactical adjustments, based on our current view of global markets.

On the asset allocation side, there are minor changes to the asset class weights, primarily small reallocations from government bonds into equities and alternatives for higher risk portfolios. For the low risk portfolios there is a minor increase in the commodity allocation which is implemented by an increased allocation to gold.

The increase of the Alternatives allocation at the expense of Global Government Bonds partially corrects the over-defensive stance of the portfolios compared to the benchmarks for high risk portfolios and partially to account for forward-looking negative returns on fixed income government instruments.

Active Range has 2-3% higher allocation to risky assets, comparing with Optima Range. This is done to express our short-term view and also to account for the active nature of the funds selected in the Active Range.

Asset selection

Optima Range. Equity allocation to the US has been reduced by 1-2% to reallocate this capital into Japanese equities. It’s been done to reduce the US Election risk and at the same time to express our positive view on Japan.

Within the Commodities bucket some weights have been adjusted to keep approximately 1/3 in Gold and the rest in the diversified commodity index product.

A new fund, SPDR Refinitiv Global Convertible Bond UCITS ETF, is added to each portfolio. The capital allocated to this fund comes mainly from the Developed Government Bonds bucket.

Active Range. In Developed Market Equities, the RAFI Dynamic Multi-Factor US Equity Fund has been removed and Baillie Gifford American was added. Now US equity weight is equally spread between Baillie Gifford American and HSBC American Index.

Emerging Market Equities exposure also has some changes. UBS Global Emerging Markets Equity has been removed and JPM Asia Growth is added. Now EME weight is equally split between JPM Asia Growth and Baillie Gifford Emerging Markets Growth. This is done to express our positive view on Asia.

DOWNLOAD FUSION DFM REBALANCE COMMENTARY